Printers For Checks

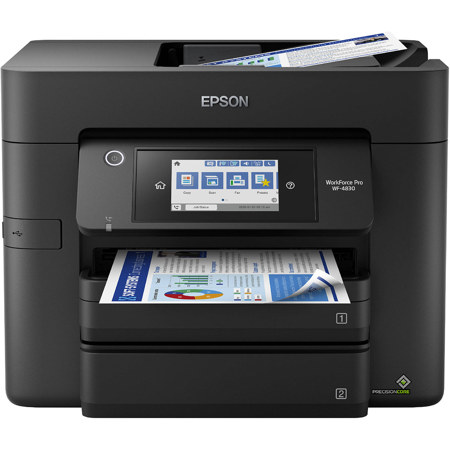

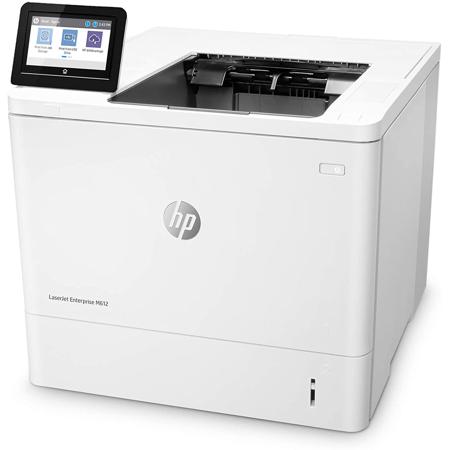

When it comes to selecting printers specifically for check printing, there are several important factors to consider to ensure security, efficiency, and compliance with banking standards. Businesses of all sizes, from small home offices to large enterprises, rely on check printing for payroll, vendor payments, and other financial transactions. The winter months, with their focus on closing out the fiscal year or preparing for tax season, often see an uptick in check printing needs. As such, having a reliable, secure printer becomes essential. The most critical requirement is compatibility with Magnetic Ink Character Recognition (MICR) toner or ink, which is necessary for the routing and account numbers at the bottom of checks to be recognized by banks and to prevent fraud. Laser printers are typically favored for their speed, crisp output, and ability to handle high volumes, making them a mainstay in busy office environments. However, for those who only need to print checks occasionally—such as freelancers, small business owners, or individuals managing household finances—an inkjet printer with MICR ink may be sufficient and more budget-friendly.

Security is paramount when printing checks, and the right printer can make a significant difference in safeguarding sensitive financial information. Look for printers that support secure check stock and offer features such as password-protected printing or secure network connectivity. Many businesses integrate their printers with accounting software like QuickBooks or specialized check-printing applications, streamlining the process and reducing the risk of manual errors. The cost of ownership should also be weighed carefully; while some printers may have a lower upfront price, the ongoing expense of MICR toner or ink cartridges can add up, especially for high-volume users. It's also wise to consider the physical durability and reliability of the printer, as check stock is often thicker than standard paper and can cause jams or wear out less robust machines. During the colder months, when mail volume increases and businesses prepare year-end payments, having a dependable check printer on hand can ensure smooth financial operations and timely disbursements.

Printers designed for check printing are not only practical for business owners and finance professionals but also make thoughtful gifts for entrepreneurs, recent graduates starting their own ventures, or anyone looking to streamline their financial workflows at home. The versatility of these printers extends beyond checks—they often handle envelopes, labels, and other specialized media with ease. If your workflow involves sending out invoices, statements, or holiday mailers, you might also be interested in printers optimized for envelopes; for more details, explore our guide to the Best Printer For Printing Envelopes. Whether you’re outfitting a new office, upgrading your current setup, or searching for a practical gift, investing in the right check printer ensures peace of mind and professionalism with every transaction. As you browse through our curated selection, keep in mind the balance between print speed, security features, and the total cost of ownership to find the perfect match for your needs.

Security is paramount when printing checks, and the right printer can make a significant difference in safeguarding sensitive financial information. Look for printers that support secure check stock and offer features such as password-protected printing or secure network connectivity. Many businesses integrate their printers with accounting software like QuickBooks or specialized check-printing applications, streamlining the process and reducing the risk of manual errors. The cost of ownership should also be weighed carefully; while some printers may have a lower upfront price, the ongoing expense of MICR toner or ink cartridges can add up, especially for high-volume users. It's also wise to consider the physical durability and reliability of the printer, as check stock is often thicker than standard paper and can cause jams or wear out less robust machines. During the colder months, when mail volume increases and businesses prepare year-end payments, having a dependable check printer on hand can ensure smooth financial operations and timely disbursements.

Printers designed for check printing are not only practical for business owners and finance professionals but also make thoughtful gifts for entrepreneurs, recent graduates starting their own ventures, or anyone looking to streamline their financial workflows at home. The versatility of these printers extends beyond checks—they often handle envelopes, labels, and other specialized media with ease. If your workflow involves sending out invoices, statements, or holiday mailers, you might also be interested in printers optimized for envelopes; for more details, explore our guide to the Best Printer For Printing Envelopes. Whether you’re outfitting a new office, upgrading your current setup, or searching for a practical gift, investing in the right check printer ensures peace of mind and professionalism with every transaction. As you browse through our curated selection, keep in mind the balance between print speed, security features, and the total cost of ownership to find the perfect match for your needs.